|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

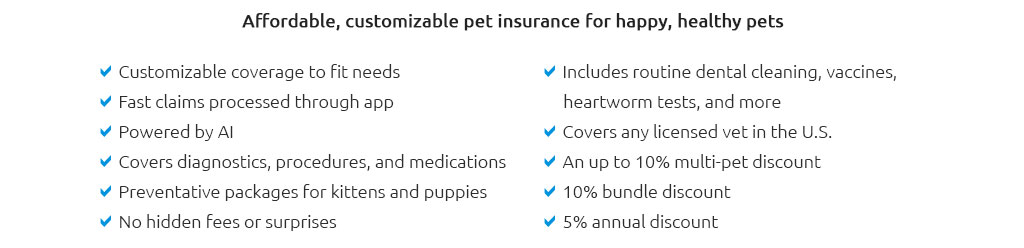

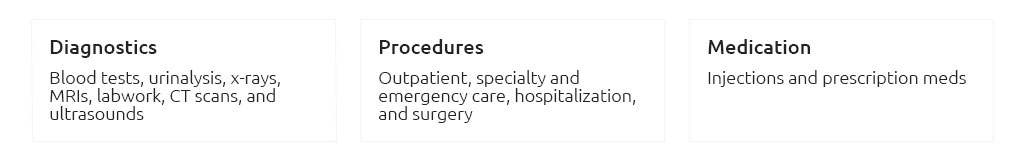

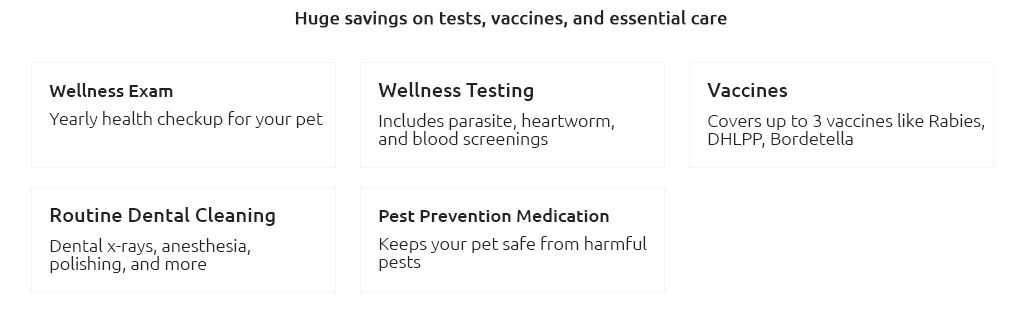

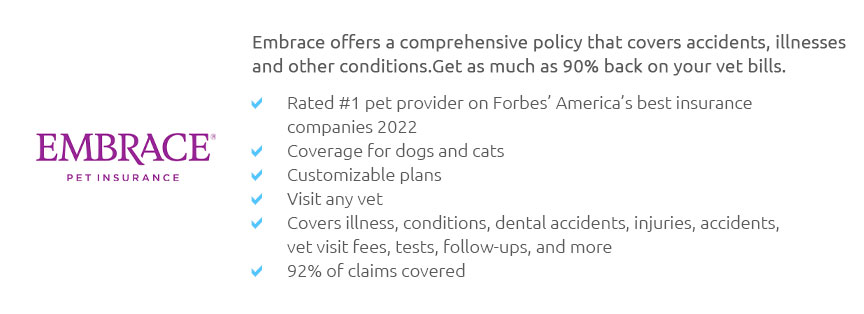

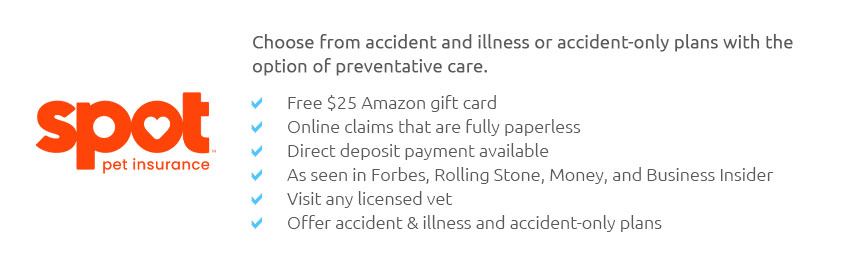

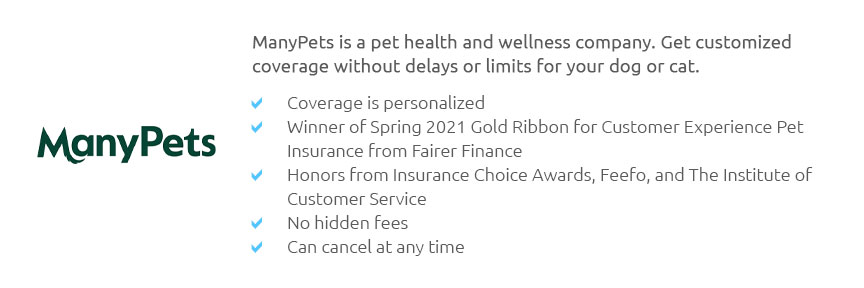

insurance on dogs: what to know before you commitWhy coverage mattersUnexpected vet bills can upend a budget, and insurance spreads that risk so your dog gets care when it matters most. From swallowed socks to chronic allergies, a policy can offset costs and give you peace of mind while you focus on recovery, not invoices. What policies usually includePlans range from accident-only to comprehensive accident-and-illness, with optional wellness add-ons. You’ll choose a deductible, reimbursement rate, and annual limit; higher deductibles typically lower premiums. Watch how claims are calculated-on the actual vet bill or a benefit schedule-and note waiting periods.

How to choose and saveCompare quotes for comparable terms, read sample policies line by line, and ask your vet which risks your breed faces. Look for multi-pet discounts, pay-in-full savings, and direct pay options where available. The right plan balances budget today with protection for tomorrow.

|